KEB Hana Bank

as one of the leading financial institution in South Korea presents KEB Hana Galaxy Program. This is a combination product between time deposit and installment saving in Hana Bank. This product has many benefits and interesting rewards for the customers.

Program Type:

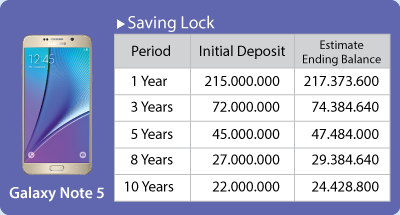

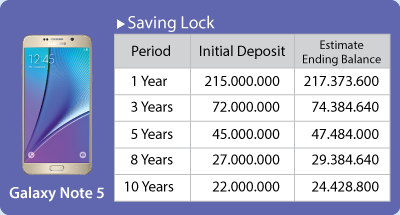

- Saving Lock

- Installment Saving

- Low Initial Deposit

- Low Monthly Installment

Requirements:

- Customer has an existing saving account in KEB Hana Bank.

- Fill account opening request form for Hana Galaxy Program.

- Copy of KTP/KITAS/Passport.

Terms & Conditions:

- Choice of gadget can be changed and modified by KEB Hana Bank at anytime.

- If the chosen Gadget is not available, KEB Hana Bank has the right to change the reward to similar type (other product & same value).

- Color of gadget depends on the availability.

- Penalty applied for the program is available on KEB Hana Galaxy Program opening request form.

- Reward will be sent within 3 working days for JABODETABEK and Cilegon. For Subang, Bandung, Semarang and Surabaya will be maximum of 5 working days.

- If the gadget is damage, complaint must be filed within two working days after the prize has been accepted. If complaint have pass 2 working days after gadget received, gadget can be delivered directly to Samsung Service Center (Guaranteed by Samsung).

KEB Hana Bank

Sebagai bank terkemuka di Korea yang berada di Indonesia mempersembahkan Program TRIPLUS Jalan - Jalan ke Korea dimana KEB Hana Bank bekerjasama dengan iB Hasanah Card dari BNI Syariah dan Happy Tour. Program ini juga disupport oleh Korean Tourism Organisation (KTO) sebagai program pengenalan budaya Korea.

TRIPLUS Jalan - Jalan ke Korea adalah sebuah program terbaru dimana nasabah akan mendapatkan 3 keuntungan sekaligus, yaitu:

- Menabung di KEB Hana Bank & menabung untuk berlibur

- Mendapatkan Kartu iB Hasanah dari BNI Syariah

- Dapat berlibur ke Korea dan mendapatkan uang saku

UDPATE JADWAL KEBERANGKATAN

- Tanggal 10-14 Juni 2015

- Tanggal 20-24 Juli 2015 (kena surcharge sekitar USD 400, karena peak season)

- Tanggal 14-18 Agustus 2015

- Tanggal 23-27 September 2015

- Tanggal 21-25 Oktober 2015

- Tanggal 25-29 November 2015

- Tanggal 23-27 Desember 2015 (kena surcharge sekitar USD 400, karena peak season)

Informasi jadwal keberangkatan selanjutnya dapat dilihat melalui:

- Customer Service Bank KEB Hana

- Call Center Bank KEB Hana

KEB Hana Bank

In collaboration with Yong Ma, we present a saving program with direct prize to customer.

Open a saving account, customer will receive Yong Ma Products for your daily household needs. KEB Hana Bank Customer will be benefitted to receive high quality product from Yong Ma.

Please visit our nearest branches *

* Only available in Jabotabek, Bandung, Medan and Lampung branches

Opening Program Terms and Conditions :

- Must have saving account in KEB Hana Bank

- Fill in the opening account form of Saving Plus

- Copy of ID card/ passport/ Limited Stay License (KITAS)

Program Terms and Conditions :

- No color choice.

- Penalty follow the term and condition in form application of Saving Plus Program.

- Prize can be acquired directly from nearest KEB Hana branches.

- Any complain can be given to the opening branches at maximum 20 working days after receiving the product. Over 20 working days, customer can take the product to the nearest Yong Ma service center.

- Interest rate assumption ± 1.00% (p.a.)

Future Mortgage Saving is a bundling program between time deposit and Mortgage targeting individual customer. KEB Hana Bank offer customer new product, which customer can save money for at least 3 years, customer will benefited with Mortgage facility with competitive interest rate.

Terms and Conditions

- Minimum saving period is 3 years up until maximum 20 years.

- After 3 years, customer have a chance to request for mortgage with low interest rate *.

- Requirement for Mortgage facility follow the terms and conditions of KEB Hana Bank.

- Maximum limit of Mortgage facility is 250x monthly installment.

- Credit limit of Mortgage facility follow existing credit process.

- Only available in IDR currency.

Product illustration descriptions:

1. Future Mortgage Saving

Min. saving for 3 years

- Monthly installment = Rp.4.000.000,-

- Saving interest rate = 1% per year.

- Ending balance after 3 years = Rp.145.776.000,-

2. Mortgage

Mortgage facility submission at 4th year, with max. Mortgage limit 250x monthly installment.

-

Mortgage limit = 250 x Rp. 4.000.000,-

= Rp. 1 bio.

- Low interest rate *.

* Mortgage interest rate is subject to change according to Bank of Indonesia interest rate. Mortgage interest rate will be reviewed every month during the period.

Mortgage Limited Fixed Rate

Monthly Installment Illustration

Customer free to choose monthly installment

Extra Benefit

Extra mortgage limit if application submit at year **:

** T is the ending tear after finishing 3 years installment. Requirement follow terms and condition apply in KEB Hana Bank.

Document requirement

- ID Number/SIM/KITAS/Passport

- Must have KEB Hana saving account/payroll as source of fund.

- Fill opening account form of Future Mortgage Saving.

Super Giro is a current account product that will give extra benefit for your business needs (Available only in IDR).

Customer who able to open Super Giro account is: Individual(Indonesian Citizen) or a brand who used a person name/company name, such as : Restaurant, store, Automotive service, Cooperation and others.

Super Giro Benefit

- Competitive services

- Free monthly administration fee

- ATM facility using Prima, Alto, and ATM Bersama

- Available in IDR currency

Super Giro interest rate table (IDR)*

*) Interest rate can change at any time

KEB Hana Bank

As a Korean leading bank in Indonesia we present signature program, in collaboration with Tiffany & Co. and Montblanc giving directly a high-value gift to customer with saving account in KEB Hana Bank

The benefits of this program is, customer saving will be locked for a certain time, and in return customer will receive high-value gift from Tiffany & Co. and Montblanc

Requirement for Opening Account

- Must have KEB Hana Bank Saving Account

- Fill in the Signature Program Opening Account Form (Program Type is Saving Lock)

- Copy of ID card/driving license/passport/Temporary Stay License (KIMS)/Limited Stay License (KITAS)/Student Card

Program Requirement

- Available in several type of gifts

- Type of gifts can be change or renewed at any time

- Program penalty follow the term and condition in application form of Signature Program

- The gift will be shipped in maximum 5 working days for JABODETABEK area and Cilegon and maximum 10 working days for Subang, Bandung, Semarang, Surabaya, Lampung, Medan, Sukabumi, and Makassar

- Estimation of saving interest rate: +/- 1.38% (p.a.)

Eligible for Cash Back Rp. 250.000,-

* Terms & condition applied

* Terms & condition applied : Cash Back will given as an Initial Deposit to open Hana Future Savings in term 6 months (same day as the opening account of Signature Program)